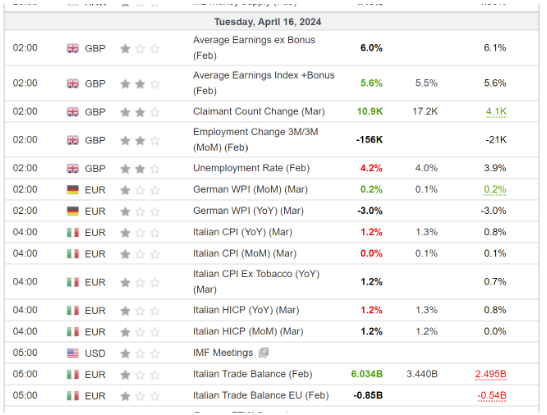

If there’s one thing we know for sure, it’s that the forex markets are extremely susceptible to economic events. With any unexpected economic announcement, the forex markets could enter massive volatility. But there’s one way to stay ahead of the game – at least for the most part. The Economic Calendar can give you a heads-up about any upcoming economic events that could potentially impact the forex markets. This calendar is available for free on most brokerage platforms. But it is important to know which economic events create the most volatility in the forex markets.

Interest Rate Decisions-

Once a month, the central banks of the world will release their new interest rates for the upcoming month. Keep in mind that if they increase the rate, you should expect bullish market conditions for that currency. However, if they decrease the rate, the value of the currency will likely take a fall. The central banks usually accompany this decision with a policy statement that gives a future outlook of the economy. This is where the forex markets tend to go overboard.

Employment Reports-

You might find this surprising, but analysts consider employment reports to be of utmost importance when understanding what impacts the forex markets. Simply put, these reports reveal the percentage of the population that is currently unemployed and looking for a job that specific month. If you’re wondering why this is important, just know that no jobs means no money. Why would you invest in a currency that is struggling in its home nation? If the unemployment rate seems to be increasing, you need to bolt in the other direction and find a new currency pair to invest in.

Political Events-

In most cases, citizens can’t control the political situation in their own country. However, political events tend to cause the most damage as economies lose their trade routes and are often facing inflation hikes in return. I’ll let you in on a little secret. While most currency pairs tend to face bearish market conditions in times of political distress, safe-havens like gold tend to thrive. You see, most people run to exchange their currencies for gold in uncertain times because they know this asset is usually stable.

Consumer Price Index-

The consumer price index basically measures the trend in the price of goods and services. It tells you whether the price of everyday goods is increasing or decreasing. I think most of us will agree that the prices these days are no doubt increasing. Here’s the thing. It doesn’t matter if the prices increase, so long as it increases but stays within the forecasted range. However, if it increases a lot more than what is forecasted, you’re going to expect some volatility. Always place your trades after you find out the result of the CPI data for the week.

Final Verdict-

This list of economic events that impact the forex markets is not long but it is still very important. A decimal above the expected range could cause the entire market to flip. If you have witnessed a market crash before, you know how devastating it is. We recommend always having an economic calendar open right next to you when you’re analyzing the market for your next trade.

Written by- Alyaziah H. (FOREXtraWealth.com contributor, forex trader, and fact checker for Investing.com)

Leave a Reply