Today, the forex market faced mid-day volatility after the US released its GDP report for the first quarter. As of right now, the US dollar is down 0.34% against the Euro, 0.47% against the British Pound, 0.31% against the Swiss Franc, and 0.38% against the Australian Dollar. However, it was also up 0.22% against the Japanese Yen. Overall, this has been a big blow on most of the US markets.

EUR/USD-

The EUR/USD currency pair started off the day at the 1.069 mark and found itself slithering upwards through the chart. It seemed like the EUR/USD was going to be in a bullish market today, but that thought was short-lived when the market crashed, and the pair found itself at its lowest point of the day at 1.067. If you bought into the market at any point while it crashed, you were in luck as the market quickly recovered and even reached as high as 1.073 today.

USD/JPY-

The USD/JPY currency pair was definitely the most stable of all the major US markets today. This comes as a surprise considering that the Japanese Yen is facing one of their lowest of lows of all time in the forex markets. The USD/JPY pair started off the day at the 155.26 mark and found itself climbing up the charts consistently throughout the day. While the USD caused instability, it was no match for the Japanese Yen which maintained stability for the pair.

GBP/USD-

The GBP/USD currency pair started off the day at the 1.245 mark as it was quickly evident that the GBP was the leading currency of the two today. The markets were consistently climbing throughout the day and only dipped once mid-day when the US released its GDP report. However, this dip didn’t cause any long-term damage as the pair quickly recovered and managed to touch its high of the day at the 1.252 mark. The GBP/USD market is now fluctuating near 1.251 and is going to close soon.

USD/CHF-

One of the most interesting markets to study in forex is the Swiss Franc markets. Switzerland is known to be a country with a very stable economy. Most people invest in Swiss banking systems because they know their assets are safe. The USD/CHF mark started off the day at the 0.914 mark and was immediately in the red zone with the bears. While the GDP release certainly caused the Swiss Franc to become unsteady, it continued to drop and is likely going to close the day at 0.912.

AUD/USD-

Today is a public holiday in Australia as they celebrated ANZAC day in the region. This is a day where they commemorate and remember their army and the sacrifices made to protect and serve the nation. As a result, the Australian Dollar was living high and mighty today with no economic releases for the entire day. The AUD/USD pair started off the week at the 0.649 mark and managed to reach a daily high of 0.653. While the market faced a short dip, it quickly recovered and is now at 0.651.

final thoughts-

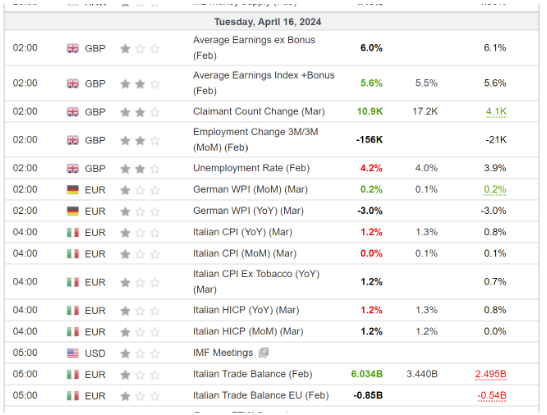

On days like today where a single economic event can trigger a chain reaction through the charts, it is important to remember how to prevent a major loss, especially with high lot trades. Always remember to put in your stop loss when entering into a trade, no matter how certain you may be that the trade will go your way. Take advantage of the market dips as your last-minute entry ticket. And don’t forget to always watch out for the economic calendar so you are never unprepared.

Written by- Alyaziah H. (FOREXtraWealth.com contributor, forex trader, and fact checker for Investing.com)

Leave a Reply